文章來源(yuan):中國有色金(jin)屬(shu)工(gong)業協(xie)會 發布時間(jian):2020-04-18

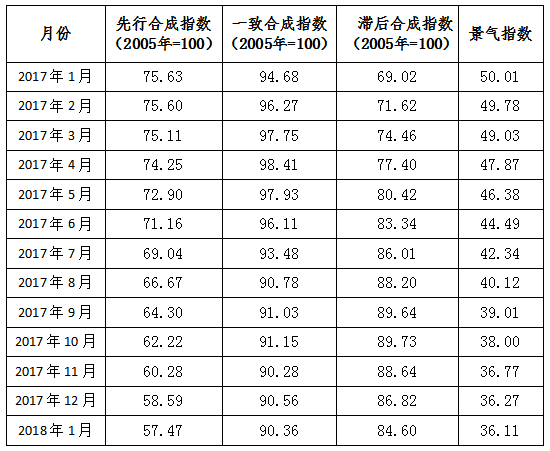

2018年1月(yue)(yue),中(zhong)色鉛鋅產(chan)業月(yue)(yue)度景(jing)氣指(zhi)數(shu)為36.11,較(jiao)上月(yue)(yue)下(xia)降0.16個點;先行合成(cheng)指(zhi)數(shu)為57.47,較(jiao)上月(yue)(yue)下(xia)降1.12個點;一致合成(cheng)指(zhi)數(shu)為90.36,較(jiao)上月(yue)(yue)下(xia)降0.2個點(近13個月(yue)(yue)鉛鋅產(chan)業月(yue)(yue)度景(jing)氣指(zhi)數(shu)如表1所示(shi))。中(zhong)色鉛鋅產(chan)業月(yue)(yue)度景(jing)氣指(zhi)數(shu)監測(ce)結(jie)果顯(xian)示(shi),鉛鋅產(chan)業景(jing)氣指(zhi)數(shu)處于“正(zheng)常”區(qu)間運行。

表1 2017年(nian)1月至2018年(nian)1月中色鉛鋅產業月度景氣指數

1、景氣指數持續回落但仍處“正常”區間運行

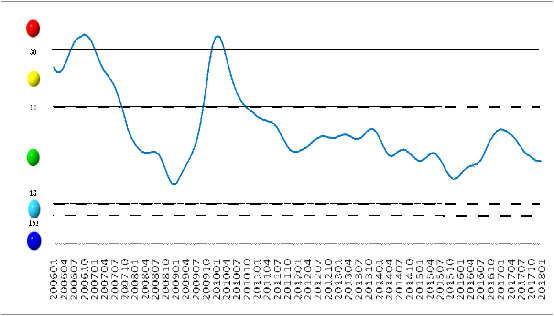

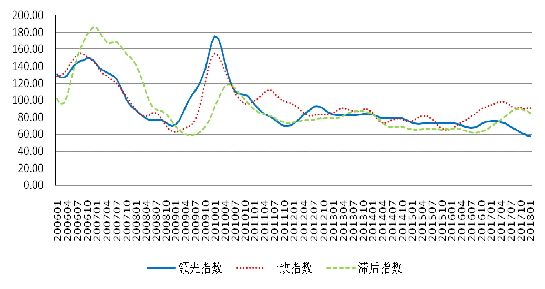

中色鉛鋅(xin)(xin)產(chan)(chan)業月(yue)(yue)度景(jing)氣(qi)指數顯示(shi),鉛鋅(xin)(xin)產(chan)(chan)業月(yue)(yue)度景(jing)氣(qi)指數持續回(hui)落,2018年1月(yue)(yue)景(jing)氣(qi)指數36.11,較上月(yue)(yue)回(hui)落0.16個點,目前(qian)景(jing)氣(qi)指數仍處“正常(chang)”區間(jian)運行。中色鉛鋅(xin)(xin)產(chan)(chan)業月(yue)(yue)度景(jing)氣(qi)指數趨勢如圖1所示(shi)。

注:![]() <過熱>

<過熱>![]() <偏熱>

<偏熱>![]() <正常>

<正常>![]() <偏冷>

<偏冷>![]() <過冷(leng)>

<過冷(leng)>

圖1 中色鉛鋅產業景氣(qi)指(zhi)數趨勢(shi)圖

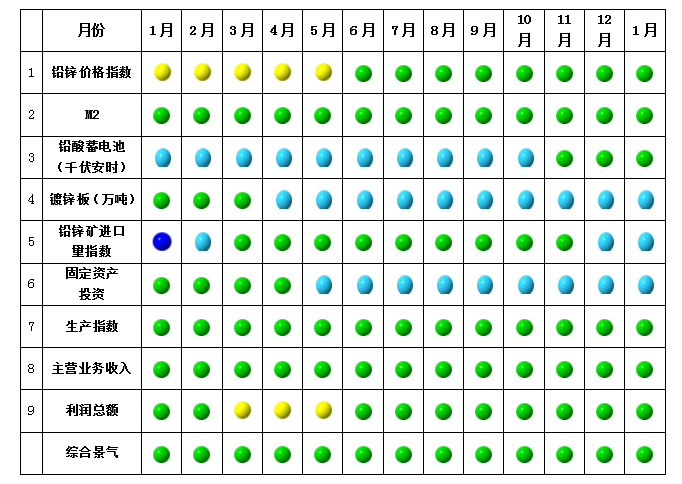

從中(zhong)色鉛(qian)鋅(xin)(xin)產(chan)業月度景(jing)氣信號(hao)燈可見(jian)(見(jian)圖2),2018年1月,在構成(cheng)中(zhong)色鉛(qian)鋅(xin)(xin)產(chan)業月度景(jing)氣指數(shu)的9個指標中(zhong):鉛(qian)鋅(xin)(xin)價格指數(shu)、M2、鉛(qian)酸(suan)蓄電池、生產(chan)指數(shu)、主營業務收入(ru)、利潤總(zong)額位(wei)(wei)于(yu)“正常”區間(jian);鍍鋅(xin)(xin)板、鉛(qian)鋅(xin)(xin)礦進口量(liang)、固(gu)定資產(chan)投資位(wei)(wei)于(yu)“偏冷(leng)”區間(jian)。

注:![]() <過熱>

<過熱>![]() <偏熱>

<偏熱>![]() <正常>

<正常>![]() <偏冷>

<偏冷>![]() <過冷>

<過冷>

圖2 中色鉛鋅產業景氣信號(hao)燈圖

2、先行合成指持續下降

2018年1月,中(zhong)色鉛鋅產業(ye)先行合成指數(shu)為57.47,較上月下降1.12個(ge)點(見圖(tu)3)。

在構(gou)成中(zhong)(zhong)色鉛鋅產業(ye)先行合成指數的6個(ge)指標中(zhong)(zhong)3漲3降(jiang)。其(qi)中(zhong)(zhong)同(tong)(tong)比(bi)(bi)增(zeng)長(chang)的3個(ge)指標中(zhong)(zhong),LME鉛鋅價格指數同(tong)(tong)比(bi)(bi)增(zeng)長(chang)19.67%、M2同(tong)(tong)比(bi)(bi)增(zeng)長(chang)8.24%、鉛酸蓄電池(千(qian)伏安時)同(tong)(tong)比(bi)(bi)增(zeng)長(chang)5.06%。同(tong)(tong)比(bi)(bi)下(xia)降(jiang)的3個(ge)指標中(zhong)(zhong),鍍鋅板同(tong)(tong)比(bi)(bi)下(xia)降(jiang)17.07%、鉛鋅礦(kuang)進(jin)口量指數同(tong)(tong)比(bi)(bi)下(xia)降(jiang)21.44%、固定資產投資同(tong)(tong)比(bi)(bi)下(xia)降(jiang)41.84%。

圖3 中色鉛(qian)鋅產業合成指數曲線圖

3、產業運行特點及對近期運行趨勢的判斷

2018年1月,鉛(qian)(qian)鋅(xin)金屬價格均(jun)呈現上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)格局,國(guo)外市場漲(zhang)(zhang)(zhang)(zhang)勢強于國(guo)內(nei)。其中LME三月期鉛(qian)(qian)月均(jun)價2587美元(yuan)/噸,環比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)3.2%,同(tong)(tong)比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)15.7%。滬鉛(qian)(qian)主(zhu)力合約(yue)月均(jun)價19445元(yuan)/噸,環比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)2.4%,同(tong)(tong)比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)5.7%。LME三月期鋅(xin)月均(jun)價3415美元(yuan)/噸,環比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)7.1%,同(tong)(tong)比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)25%。滬鋅(xin)主(zhu)力合約(yue)月均(jun)價26270元(yuan)/噸,環比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)4.5%,同(tong)(tong)比上(shang)(shang)(shang)漲(zhang)(zhang)(zhang)(zhang)18.4%。

2017年(nian)中國鉛(qian)(qian)鋅(xin)(xin)生(sheng)(sheng)產(chan)整體呈現(xian)鉛(qian)(qian)增鋅(xin)(xin)減的格局。精(jing)(jing)煉(lian)鉛(qian)(qian)、鉛(qian)(qian)精(jing)(jing)礦(kuang)產(chan)量(liang)同(tong)比(bi)(bi)(bi)均出現(xian)增長(chang),精(jing)(jing)煉(lian)鋅(xin)(xin)、鋅(xin)(xin)精(jing)(jing)礦(kuang)產(chan)量(liang)同(tong)比(bi)(bi)(bi)下(xia)降(jiang)。其中精(jing)(jing)煉(lian)鉛(qian)(qian)產(chan)量(liang)增長(chang)主要來自再(zai)生(sheng)(sheng)鉛(qian)(qian),再(zai)生(sheng)(sheng)產(chan)鉛(qian)(qian)生(sheng)(sheng)產(chan)大(da)(da)省(sheng)(sheng)安徽省(sheng)(sheng)、江蘇省(sheng)(sheng)全年(nian)產(chan)量(liang)增長(chang)明顯(xian),兩省(sheng)(sheng)全年(nian)產(chan)量(liang)分別(bie)為82.8萬噸和31萬噸,同(tong)比(bi)(bi)(bi)增幅45.21%和104.01%。2017年(nian)精(jing)(jing)煉(lian)鋅(xin)(xin)產(chan)量(liang)同(tong)比(bi)(bi)(bi)小幅下(xia)降(jiang),分省(sheng)(sheng)份看傳統精(jing)(jing)煉(lian)鋅(xin)(xin)生(sheng)(sheng)產(chan)大(da)(da)省(sheng)(sheng)除(chu)云南省(sheng)(sheng)產(chan)量(liang)同(tong)比(bi)(bi)(bi)有所增長(chang)外(wai),陜西、湖南兩省(sheng)(sheng)產(chan)量(liang)同(tong)比(bi)(bi)(bi)下(xia)降(jiang),兩省(sheng)(sheng)全年(nian)產(chan)量(liang)101萬噸和99.5萬噸,同(tong)比(bi)(bi)(bi)降(jiang)幅3.80%和8.66%。此外(wai),2017年(nian)鋅(xin)(xin)精(jing)(jing)礦(kuang)產(chan)量(liang)下(xia)降(jiang)明顯(xian),全年(nian)鋅(xin)(xin)精(jing)(jing)礦(kuang)含鋅(xin)(xin)產(chan)量(liang)326.8萬噸,同(tong)比(bi)(bi)(bi)下(xia)降(jiang)8.58%。原料供應(ying)方面,受2017年(nian)全球(qiu)鉛(qian)(qian)鋅(xin)(xin)精(jing)(jing)礦(kuang)供應(ying)增長(chang)有限(xian)及中國環(huan)保因素導致部(bu)分不合(he)規產(chan)能關停影響,全年(nian)鉛(qian)(qian)鋅(xin)(xin)精(jing)(jing)礦(kuang)供應(ying)呈現(xian)緊張態勢,鋅(xin)(xin)精(jing)(jing)礦(kuang)供應(ying)缺口大(da)(da)于鉛(qian)(qian)精(jing)(jing)礦(kuang)。

消(xiao)費方(fang)面,2017年鉛(qian)消(xiao)費趨(qu)弱,鋅消(xiao)費好(hao)于(yu)(yu)預期。全(quan)年鉛(qian)初級消(xiao)費領(ling)(ling)域(yu)鉛(qian)酸蓄電池產(chan)量(liang)(liang)、出(chu)口量(liang)(liang)同(tong)比(bi)下降(jiang),終端消(xiao)費領(ling)(ling)域(yu)電動自行(xing)車(che)(che)產(chan)量(liang)(liang)下降(jiang),汽車(che)(che)產(chan)量(liang)(liang)同(tong)比(bi)雖有所增長,但增速(su)亦出(chu)現下降(jiang)。鋅消(xiao)費方(fang)面,全(quan)年鋅初級消(xiao)費領(ling)(ling)域(yu)鍍鋅板(ban)產(chan)量(liang)(liang)同(tong)比(bi)下降(jiang),終端消(xiao)費領(ling)(ling)域(yu)表現好(hao)于(yu)(yu)預期,汽車(che)(che)、冰箱、洗衣機、空(kong)調(diao)等(deng)產(chan)品產(chan)量(liang)(liang)均出(chu)現不(bu)同(tong)程度增長。

整(zheng)體(ti)來看,鉛(qian)鋅(xin)產業在價格同比(bi)上(shang)漲、原料供應緊張、消費(fei)有所增長(chang)的背(bei)景(jing)下,生產經營平穩。產業主(zhu)營業務收入、實現利潤(run)總額同比(bi)好于(yu)2017年同期。

從未來(lai)發(fa)展上看(kan),2018年(nian)上半年(nian)鉛鋅精礦原料供(gong)應(ying)緊張的趨勢難有實質性改觀。此(ci)外環保(bao)要求(qiu)不減,2017年(nian)10月1日起(qi)將在(zai)“2+26”城(cheng)市(shi)實行特別排(pai)放限值,2018年(nian)1月1日起(qi)將開始征(zheng)收環保(bao)稅。產(chan)業面臨來(lai)自原料供(gong)應(ying)緊張及環保(bao)要求(qiu)提高的雙(shuang)重壓(ya)力(li)。

綜上所(suo)述,并(bing)結合中色鉛(qian)鋅產(chan)業(ye)月度先行(xing)指數,中國鉛(qian)鋅產(chan)業(ye)雖面臨環保要(yao)求不斷(duan)提高(gao)所(suo)帶來的(de)生(sheng)產(chan)經(jing)營成本剛性(xing)上升壓力(li),并(bing)在(zai)2018年初(chu)原(yuan)料供(gong)應(ying)緊張態勢不減(jian)的(de)背(bei)景下,鉛(qian)鋅價格(ge)仍有(you)支撐,產(chan)業(ye)整(zheng)體生(sheng)產(chan)經(jing)營盈利空(kong)間(jian)依然(ran)存在(zai)。初(chu)步判斷(duan),2018年初(chu)鉛(qian)鋅產(chan)業(ye)依然(ran)能維持平穩運行(xing),產(chan)業(ye)景氣指數將繼續在(zai)“正常”區間(jian)運行(xing)。(馬駿(jun)執筆)

附注:

1、鉛鋅產業景氣先行合成指數(簡稱:先行指數)用于判斷鉛鋅產業經濟運行的近期變化趨勢。該指數由以下6項指標構成:LME鉛鋅價格指數、M2、鉛酸蓄電池、鍍鋅板、鉛鋅礦進口量指數、固定資產投資指數。

2、鉛鋅產業一致合成指標(簡稱:一致指數)反映當前鉛鋅產業經濟的運行狀況。該指數由以下3項指標構成:生產指數、主營業務收入指數、利潤總額指數。

3、鉛鋅產業滯后合成指標(簡稱:滯后指數)與一致指數一起主要用來監測經濟變動的趨勢,起到事后驗證的作用。該指數由以下3項指標構成:流動資本余額、應收賬款總額、產成品余額。

4、綜合景氣指數反映當前鉛鋅產業發展景氣程度。景氣燈號圖把鉛鋅產業經濟運行狀態分為5個級別,“紅燈”表示經濟過熱,“黃燈”表示經濟偏熱,“綠燈”表示經濟運行正常,“淺藍燈”表示經濟偏冷,“藍燈”表示經濟過冷。對單項指標燈號賦予不同的權重,將其匯總而成的綜合景氣指數也同樣由5個燈區顯示。

綜合景氣指數由9項指標構成,即先行指數和一致指數的構成指標。

5、編制指數所用各項指標均經過季節調整,已剔除季節因素。

6、每月都將對以前的月度景氣指數進行修訂。當時間序列加入最新的一個月的數據后,以往月度景氣指數會或多或少地發生變化,這是模型自動修正的結果。

7、生產指數,包括國內生產鉛、鋅精礦金屬含量、精煉鉛、鋅產量。進口量指數,包括進口鉛、鋅精礦含鉛、鋅量、進口精煉鉛、鋅金屬量。

【責任編輯:李瑛】